when are property taxes due in kane county illinois

That updated market value is then taken times a composite rate from all taxing entities together to calculate tax assessments. Accorded by state law the government of your city public schools and thousands of various special purpose units are given authority to evaluate real property market value fix tax rates and levy the tax.

Franklin Park Water Tower Real Estate Appraisals In Chicago Suburbs Certified Appraisers Listed On The Fha Ros Franklin Park Water Tower Homeowners Guide

PROPERTY TAX DUE DATE REMINDER KANE COUNTY TREASURER DAVID J.

. When are property taxes due in kane county illinois Tuesday February 15 2022 Edit Transfer Taxes What Are They How Much Are They Who Pays Mortgage Blogs Federal Student Loans Private Student Loan. As recognized legal governmental entities theyre administered by elected officials or appointed officers. Kilbourne announced today Thursday April 22 2021 that Kane County property tax bills will be mailed on April 30.

The break will not apply to payments done through a third. Kane County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Because if your payment doesnt reach by the due date then your tax will become delinquent and you will be charged a.

Breaking News Communities Consumers Education Events Government Homeowners Kane County Treasurers Office Property Values Public Service Real Estate Taxpayers. Kilbourne MBA announces that 2020 Kane County Real Estate tax bills that are payable in 2021 will be mailed on April 30 2021. 2022 Senior Freeze Tax Conversion Chart converts 2021 federal.

You must apply for the exemption with the County Assessment Office. County boards may adopt an accelerated billing method by resolution or ordinance. Kane County Treasurer Michael J.

Kilbourne announced today Thursday April 22 2021 that Kane County property tax bills will be mailed on April 30. So if you pay on the due date your payment must reach 1200 pm. Property taxes are paid at the Kane County Treasurers office located at 719 S.

Payments made online can take up to 72 hours to receive in Treasurers office. Kane County Treasurer Michael J. This exemption is limited to the fair cash value up to an annual maximum of 75000 or 25000 in assessed value which is 33 13 percent of fair cash value that was added to homestead property by any new improvement eg remodeling adding a new room or rebuilding after a catastrophic event and.

6302325990 CunninghamJohncokaneilus Website Kane County Circuit Clerk Theresa Barreiro Phone. 3164 - COURTYARDS OF. Property taxes come due in june and september every year but the proposal if passed as a bill by the state legislature would allow taxpayers to forego interest and late penalties on their june.

The County Clerk tax staff calculates the tax rate set within statutory limits by the local board for each taxing district t o each propertys valuation set by the Township Assessor. 630-208-7549 Office Hours Monday Thru Friday. 3315 - BUONA ST.

The Kane County Board approved a plan to ensure no one pays late fees on payments due June 1 as long as they are turned in by July 1. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill. The median property tax also known as real estate tax in Kane County is 511200 per year based on a median home value of 24500000 and a median effective property tax rate of 209 of property value.

An assessor from the countys office determines your real estates value. CHARLES OFFICE CONDO AMEND PER 2015K018901. 6302323565 KilbourneMichaelcokaneilus Website Kane County Clerk John Cun ningham Phone.

Kane County Property Tax Inquiry. Batavia Avenue Geneva ILYou may call them at 630-232-3565 or visit their website at. Those entities include Kane the county districts and special purpose units that make up that total tax levy.

Kane County collects on average 209 of a propertys assessed fair market value as property tax. Kilbourne announces that 2021 Kane County Real Estate tax bills are. KANE COUNTY TREASURER Michael J.

After the initial application is approved you will be mailed a renewal form each subsequent year. The county collector is charged by the county clerk to collect all of the taxes levied by approximately 270 local taxing bodies within kane county. Kane County Treasurer 719 S.

6302323413 BarreiroTheresacokaneilus W ebsite. On Property Tax Bills To Be Mailed April 29 1st Installment Due June 1. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000.

In most counties property taxes are paid in two installments usually June 1 and September 1. The levies for each local taxing body are set by each Kane County Unit of Governments governing board. Kane County Treasurer Michael Kilbourne.

WILL COUNTY WLS -- Residents and business owners in Will and Kane counties are worried about the thousands of dollars in property tax payments soon to. If you are a new or existing homeowner and need a copy of the bill to remit payment you may print off a bill from the Internet by visiting the. The median property tax also known as real estate tax in Kane County is 511200 per year based on a median home value of 24500000 and a median effective property tax rate of 209 of property value.

You can get the 2022 application here or you can call 630-208-3818 and one will be mailed to you. RICKERT would like to remind taxpayers that the second installment of property taxes is due September 4th. The first installment will be due on or before June 1 2021 and the second installment will be due on or before Sept.

The first installment will be due on or before June 1 2021 and the second installment will. 3317 - COURTYARDS OF ST. Kane County has one of the highest median property taxes in the United States and is ranked 32nd of the 3143 counties in order of median property taxes.

20 - 423-429 E CHICAGO STREET CONDO. Bldg A Geneva IL 60134 Phone.

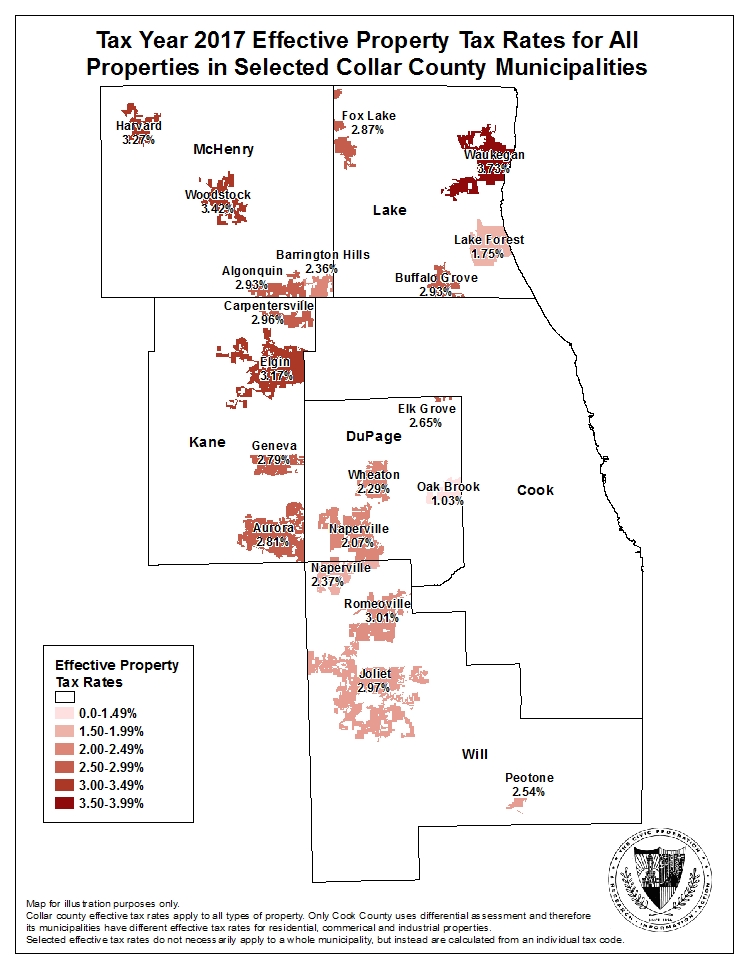

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

How To Appeal Property Taxes In Geneva Il Beautiful Places Valley View Forest Preserve

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

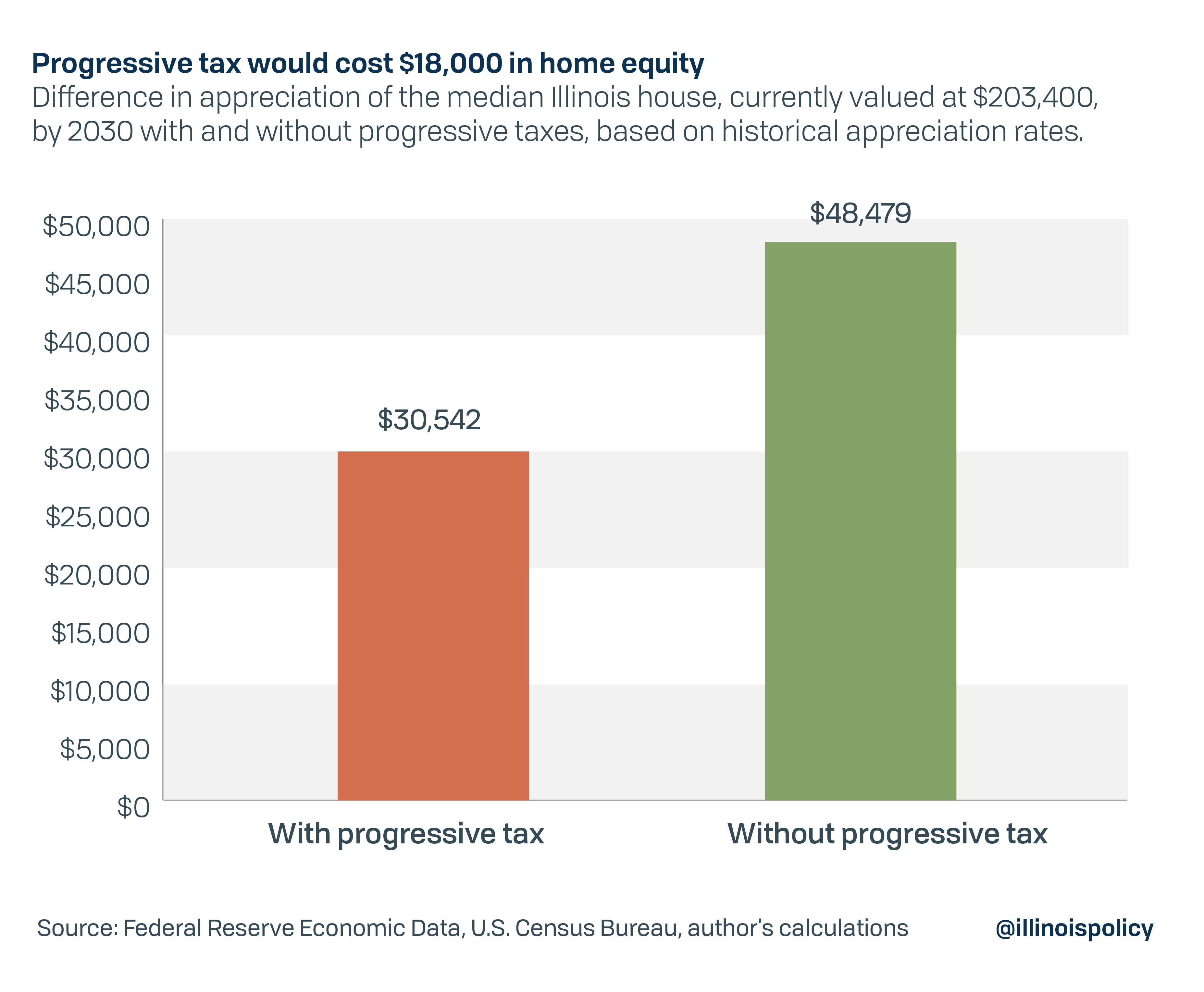

Progressive Tax Could Cost Nearly 1 800 A Year In Home Equity Illinois Policy

2022 Illinois Tax Filing Season Begins Jan 24 Kane County Connects

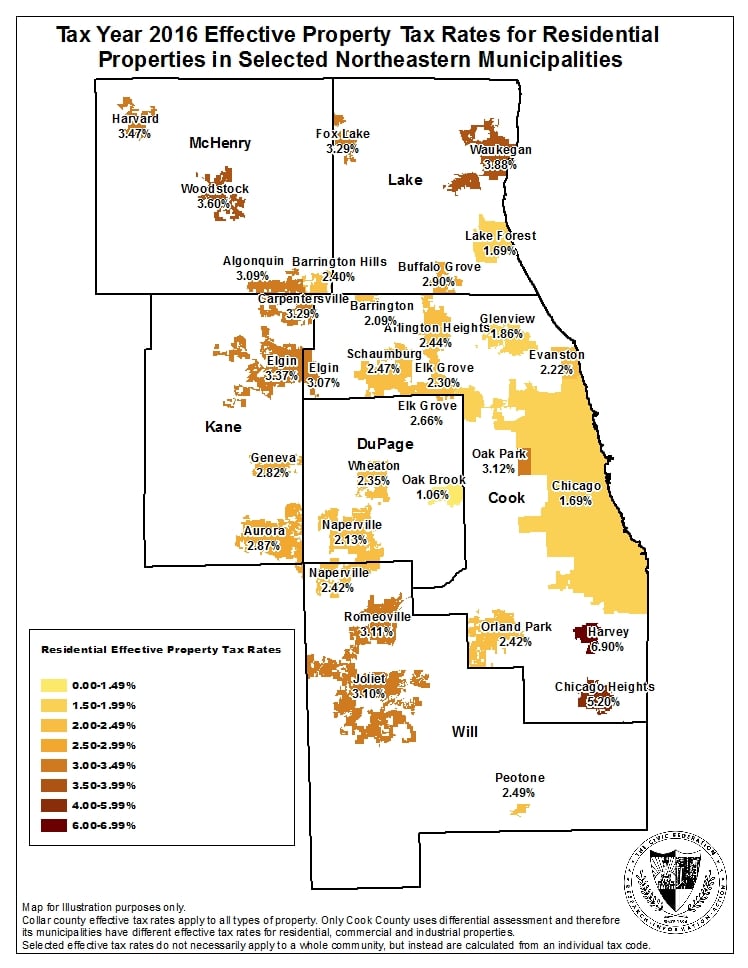

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

Transfer Taxes What Are They How Much Are They Who Pays Mortgage Blogs Federal Student Loans Private Student Loan

Kane County Waives 30 Day Property Tax Payment Penalty Kane County Connects

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Illinois Budget Includes 1 Billion In One Time Relief For Grocery Gas Some Property Taxes Kane County Connects

2022 Illinois Tax Filing Season Begins Jan 24 Kane County Connects

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

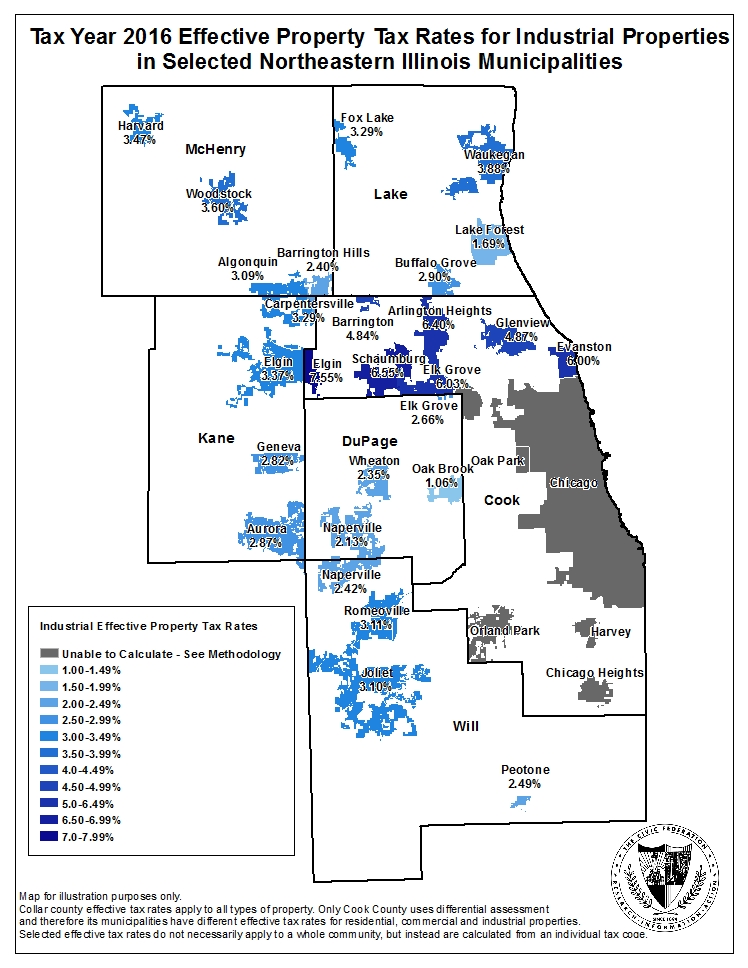

Estimated Effective Property Tax Rates 2007 2016 Selected Municipalities In Northeastern Illinois The Civic Federation

Homes For Rent In Kane And Mchenry County In 2022 Renting A House Real Estate News Algonquin

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Estimated Effective Property Tax Rates 2007 2016 Selected Municipalities In Northeastern Illinois The Civic Federation

Chicagoland Il Area Counties 2020 2nd Installment Property Tax Due Dates Chicagoland Mchenry Real Estate News